Gina Knox – Small Business Money School

$997.00 Original price was: $997.00.$95.00Current price is: $95.00.

Download Gina Knox – Small Business Money School

Learning Small Business Finances: Why Gina Knox – Small Business Money School Is the Course of Instruction You Need

You’re not alone if you have ever felt as though small business finances are some strange mixture—think algebra meets taxes with a sprinkle of stress. Actually, a U.S. Bank study indicates that inadequate cash flow management accounts for 82% of small firms failing. But what if learning the financial situation of your company could be, well, far more approachable (and dare we say, entertaining)? Welcome to Gina Knox – Small Business Money School, where real business success is totally within your reach and financial fluency is no more limited to accountants.

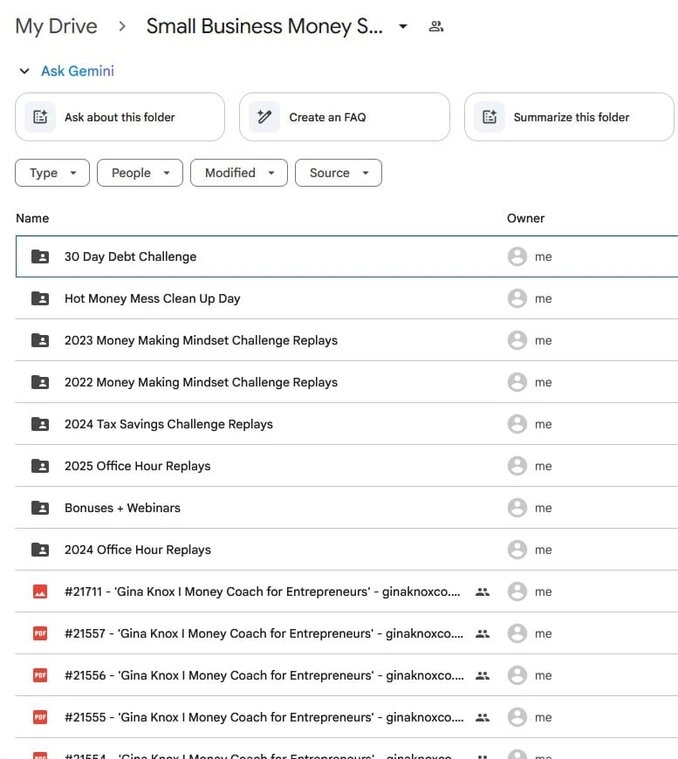

Proofs

Crucially, we will examine how Gina Knox – Small Business Money School offers practical, customized education meant to close the gap between “I own a business” and “I manage a thriving, profitable business.” We will also take a guided tour through the ins and outs of managing finances for small businesses and uncover why cash flow trips up so many entrepreneurs. By the conclusion, not only will you understand why financial education is important for business owners, but you will also have practical suggestions to translate your financial skillset from “Hmm?,” to “Heck yes!”

Why Do Most Small Business Owners Find Finances Difficult?

Forty percent of business owners, according to SCORE, say taxes and bookkeeping are the toughest aspects of running their companies. The conflict is real; numbers, words, conformity, and apparently limitless forms all play roles. To be honest, though, the issue is more general than only dislike of documentation. The true offender is a dearth of easily applicable financial knowledge.

To be honest, most of us didn’t start companies since we love ledgers or financial accounts. We wanted to be our own boss, serve others, or maybe both. Many entrepreneurs, however, avoid knowing their profit and loss even if they work late nights for marketing or product development. QuickBooks reports that sixty percent of small business owners believe their knowledge of accounting and finance is restricted.

Usually, the path taken by a small business looks like this:

Pour heart and soul—and, to be honest, bank account—into starting the company.

Cross fingers to indicate the money sorts itself.

When tax season (or a cash crunch) approaches, you end yourself worried.

Small Business Money School seeks to break that loop and enable you to boldly call the shots where financial matters are concerned.

The Gina Knox Approach: Financial Education Designed for Not Accountants but Entrepreneurs

To clear the record, Gina Knox is not instructing sleepless CPAs in accounting theory. She created the Small Business Money School to provide real-world business owners with useful, doable actions based on the foundations of financial wellness. After all, if a spreadsheet cannot enable you to plan for the future and sleep at night, then what use it?

Demanding the Essentials: Breaking Them Down

Here is a sample of the course offerings at Gina Knox – Small Business Money School:

Cash Flow Mastery: From the time your money enters your company until it leaves your account, know its pulse. Accidental late payrolls and overdraft surprises are gone!

Beyond “just cover expenses,” profit planning genuinely strategizes for sustainable development and takes-home profit.

Budgeting (Without the Boredom): Discover methods for both multitaskers and creative brains.

Financial Decision-Making: Not an MBA necessary; tools and templates to help you feel good about significant (as well as little) financial decisions.

Actual Results: What the Numbers Tell

Students who make financial education investments observe clear benefits. Small firms with greater financial literacy are 2.5 times more likely, according to the SBA, to survive five years or longer. And Gina Knox’s approach alters your company path rather than only provides knowledge; former students claim up to a 30% monthly profit within six months of using core Money School ideas.

Changing Your Viewpoint Regarding Business Income

By now you might be wondering, “Okay, but am I really a ‘numbers person?'” Here is some myth-busting: uncertainty, not ineptitude, causes most financial hardship. Gina Knox – Small Business Money School is painstakingly crafted to enable you move from reactive (dealing with money issues as they develop) to proactive (planning with certainty).

From “Guessing” to “Knowing.”

Usually, the difference between a stressed-out business owner and a strategic one is data against guesses. Money School guides small business owners:

How to interpret your own profit and loss (P&L) reports using terminology you know?

For your capacity to pay a paycheck, make investments in expansion, or pivot as markets shift, those figures really represent something.

How can you see red flags (and green lights) early on so that you respond deliberately instead of running from disaster?

The “Money Meeting”: Your New Ritual Favorite

The Gina Knox approach stands out for include frequent “Money Meetings.” You schedule time once a week or once a month to review your stats, create goals, and really enjoy the process. Consider it as a kind of bank account self-care regimen. Students said that one behavior helps them to make their finances seem more like a puppy they’re glad to train than like a frightened monster.

Typical Business Money Stories – Bustled

Let’s quickly refute the three most harmful misconceptions to truly value what Gina Knox – Small Business Money School can offer:

First myth: “My financial problems will magically vanish if I simply increase sales.”

Not quite fast! 29% of failing firms overspent without knowing their actual profitability, according to research released by CBInsights. If you lack a system, more sales might really magnify financial mismanagement.

Second myth: “Accountants will manage all my money stuff, right?”

Though they come in after the fact and cannot create daily spending plans or financial strategies for you, accountants are great allies. Put otherwise, you remain the CEO.

My third myth is “It’s too late for me to get on top of this.”

Another wrong. Financial clarity is not a one-time arrangement; it is a continuous habit. Whether you have been in company six months or six years, it is never too late to take control of your money.

Essential Attributes of Gina Knox – Small Business Money School

Let us be clear. Out among the multitude of financial programs and spreadsheets, what specifically distinguishes the Gina Knox Small Business Money School? The following summarizes what distinguishes it from the others:

Bite-sized, active lessons

Forget thousand-page books or six-week monster courses. Every module is brief, direct, and meant to be started right away—that means you won’t lose momentum—or your will to live.

Neighborhood and Responsibility

Students now have access to a special online network where problems are solved creatively, accomplishments are honored, and questions get answered. By up to 40% compared to single learning, peer responsibility and support help to raise program completion rates.

Lifetime Access (since finance isn’t “one and done”).

Markets shift and your company grows. Gina Knox provides lifetime access to materials and community through Small Business Money School. The course changes with you anytime you need a refresher or need to enhance your skills.

Devices That Make Sense

Practical templates, checklists, and dashboards reflecting small business operations—not Fortune 500 firms with a full-time financial team—are part of the program.

Live Coaching Calls

One can find special difficulties in business finance. Gina Knox bridges the theory-to–your-specific company reality by offering regular live coaching and Q&A sessions.

Who should sign up for Gina Knox – Small Business Money School?

You suit quite well if you find yourself in these situations:

Opening your business bank account makes you nervous. (Not anymore—you will eagerly await it!)

You might not be able to regularly pay yourself or even give yourself a raise.

Though you’re not sure if you can afford it, you want to employ, grow, or invest.

Though you wish you had a “financial coach,” you don’t want to pay hundreds per month.

You want to run a company in line with your aspirations, not only survive by chance.

From brand-new entrepreneurs to multi-year company owners looking for a “reset,” or refresh on their financial management abilities, students vary. Except for the will to study and act, there are no requirements.

The Real-World Effect: Statistically Supported Success Stories

Stories about actual transformation are the best. Gina Knox: Alumni of Small Business Money School report

Thirty percent average profit increase in six months following Money School tool application

75% less financial worry, as reported on post-course polls

Four of five participants claim to have at last started regularly paying themselves for the first time.

One kid stated it exactly: “I used to hope I’d have enough for taxes every quarter. I know now I will—because I have scheduled for it. That security shapes my presence in every facet of my company.

How to Start Small Business Money School

Enrolling is easy—designed with businesspeople in mind. Direct registration for Gina Knox – Small Business Money School can be done here. Once inside, you get quick access to all course materials, extra resources, and the exclusive community.

Advice on Best Use of Your Money Education Experience

Get committed to frequent “Money Meetings.” Even thirty minutes a week changes everything.

interact with the community. Get comments, share your successes, and probe more.

One tool at a time, then another. Steer clear of trying to revamp.

Be the first to review “Gina Knox – Small Business Money School” Cancel reply

You must be logged in to post a review.

Related products

All Courses

Business

All Courses

Business

All Courses

Reviews

There are no reviews yet.